A Tale of Two Markets

2021 was an extraordinary year for property owners who saw home values increase even amid a lingering climate of economic uncertainty. More good news: the economy is behaving predictably. The Chamber’s annual Real Estate Review & Economic Forecast, sponsored by Mason County Association of Realtors, delved into these and other trends with subject experts on real estate and complex movements shaping our financial future.

Gathering virtually for the insights and stats, the speakers on November 18 led listeners through facts and figures to paint a picture of how things have changed since COVID began. Andy Conklin, certified residential specialist with The Conklin Team at Windemere/Himlie Inc., offered perspective on Mason County real estate. One incredible fact revealed that the median price of a home is 20.8% more than last year, coming in at $374,500! Every corner of the county saw a year-over-year increase with the Cloquallum/Matlock/Dayton area being the highest at 32%; other areas ranged from 12%-28%.

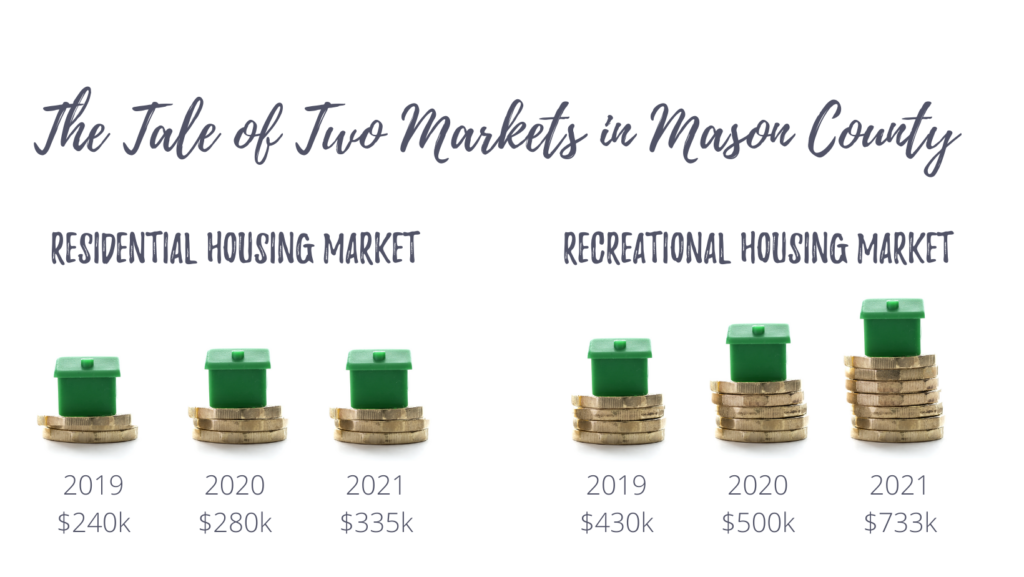

Conklin summarized there are really two types of properties on the market in Mason County: lots without views or waterfront (residential), and those with prime plots and amenities (recreational). Comparatively, median average sale for the former is $335,000, versus $735,000 for the latter. Furthermore, the demand for recreational property has driven thirty-six home sales this year for over $1 million while last year there were just four.

What does that mean for housing affordability? Mason County is still the most affordable and best value in all South Puget Sound. The housing affordability index sits at 84, calculated using the current median wage of $57,634 per year. The index itself measures whether a typical family can qualify for a mortgage loan on a typical home; an score of 100 represents exactly enough income to qualify. Inventory remains tight, keeping the advantage with the sellers, although the number of active listings year to year hasn’t changed much since 2019.

James McCafferty, Director of Western Washington University’s Center for Economic and Business Research, observed the larger economic landscape and introduced considerations as to why our country hasn’t tanked despite all the COVID impacts. Essentially, 10% of jobs drive our global economy, and their performance was unphased by the disaster.

McCafferty acknowledged that he often hears musings from the public on how that can be when there are so many open jobs, but says the ‘great resignation’ is just about people not reentering the workforce. A number of Baby Boomers retired, some working families decided childcare wasn’t worth the expense, and others purposely stepped out of the workforce. Unemployment has now stabilized because those no longer in the workforce aren’t counted in the labor participation rate. Next year, another 2,742 available jobs are projected in Mason County with 839 of those being new roles.

Currently, the largest risk to our economy is consumer behavior according to McCafferty. “Consumers can literally talk themselves into a calamity,” he says. “The way we act drives 70% of supply and demand which creates regional variances and complications. Overall, the economy is functioning well right now and spending behavior has bounced back.”

Consumers can complicate things with only considering partial information about inflation, supply chain issues, and daily prices like those at the grocery. The larger view is measured by numerous data points. In fact, the consumer price index isn’t favored as a status of the economy; the Fed doesn’t even utilize it. Nor is the number of cargo ships unable dock to unload goods; we simply ship more now than ever in history. It’s not even the price at the gas pump; prices have been relatively stable for decades when adjusted for inflation.It’s simply about consumer confidence and spending habits. So, it may be wisest to choose optimistically.

McCafferty suggests we are not on the verge of a great recession, but rather a great reset. A period of anxiety is natural after a natural disaster or, in this case, a pandemic. Now normalcy is keeping inflation at bay. Although specific products will see a temporary spike or dip in the market, whatever happens next is on us as consumers (for the most part).

View the complete presentation & video recording of the 2021 Real Estate Review & Economic Forecast, click here.